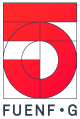

Open RAN is designed to ensure interoperability between different manufacturers (Source: Telefónica)

Last but not least, the boycott of Chinese suppliers by a number of industrialized countries has promoted the development of Open RAN. Overcoming the oligopoly of Huawei, Nokia and Ericsson, cheaper prices and more innovation should enable the concept. But can the high-flying expectations actually be met? Recently, more and more critics and doubters have spoken out.

Shortly before Christmas, five major European mobile operators sounded the alarm: Europe is lagging behind the US and Japan in the development of Open RAN, Warned Deutsche Telekom, Orange, Telecom Italia, Telefónica and Vodafone in a joint statement. There is a lack of companies on the continent that develop key components for Open RAN technologies. Silicon chips in particular are to be mentioned here – currently the US company Intel dominates the Open RAN solutions with its CPUs, assisted by the self-developed FlexRAN platform. On the other hand, the European telcos criticize the lack of support for the Open RAN initiative by the local infrastructure providers Nokia and Ericsson.

Open RAN in the test – but not on the net

All three German mobile operators are involved in Open RAN – on the one hand in the committees, on the other hand in experimental arrangements. For example, Deutsche Telekom has proclaimed the O-RAN Town in Neubrandenburg – with up to 25 locations, massive MIMO radio units are to be tested in live operation there. Vodafone is conducting a similar pilot test in Plauen, Telefónica/O2 is active with three stations in Landsberg am Lech, Bavaria.

The field trials in Neubrandenburg and Plauen are being supported with funding as part of an Open RAN initiative of the Federal Government. By November 2021, 31 million euros had been invested in various projects. The Federal Ministry of Transport and Infrastructure (BMVI) will provide 300 million euros in the coming years.

Telefónica announced that, after successful tests, Open RAN will be rolled out on the net from autumn 2021. So far, however, only a manufacturer-independent SDN interface has been used in the nationwide O2 mobile network. It serves to simplify the management of the 30,000 microwave links. Vodafone, on the other hand, is more critical of the current status. There is a lack of European and German providers for Open RAN, they do not want to contribute to shifting the market share to North America, Gerhard Mack, Chief Technology Officer,explained the reluctance of Vodafone.

European suppliers: From “No” to “Yes, but…”

While Ericsson is fundamentally skeptical about the Open RAN concept, Nokia has pledged its fundamental support. But implementation is faltering. In August, Nokia suspended its participation in the Open RAN Alliance. The body, which was founded in 2018 by five companies to drive open RAN technologiesthat enable easier replacement of Huawei components, now has 260 members. Among them are 44 from China, many with close ties to the Chinese state, three of them even explicitly on the boycott list of the USA. Not only the Finnish supplier fears that the cooperation with such companies within the framework of the alliance could have negative consequences for the US business.

A second accusation against Nokia is that the solutions presented undermine the Open RAN idea. For example, the supplier is accused of having developed an Open RAN software with open interfaces. However, the decoupling of hardware and software is not implemented – so that the Nokia software can only run on Nokia hardware.

Open RAN just a series of myths?

This is grist to the mill of the Danish consulting company StrandConsult. This was stated at the turn of the year: “Many speak of Open RAN, but mobile operators still buy classic RAN”. The economic reality speaks against the concept: Even if OpenRAN achieves the success predicted by its proponents, the Open RAN share of 5G mobile sites in 2025will be less than 1percent, in 2030 no more than 3 percent.

StrandConsult tries to prove the reasons for this development in an extensive report, which is intended to debunk 25 myths about Open RAN (website). One of the points: the various Open RAN associations are not standardization bodies, such as the 3GPP, which develops uniform technical specifications to which the entire industry adheres. Accordingly, there are problems with manufacturer-specific interpretations and a lack of progress,possibly deliberately caused by the big players. They have no interest in opening the door to a lucrative market for smaller competitors. Last but not least, Open RAN is also a delay strategy towards the Huawei-critical governments: They have been promised in part to replace the Chinese components if Open RAN technologies are marketable.

Justified criticism of Open RAN

The analysis of StrandConsult can also score points elsewhere. For example, the proponents of the open standard assume that costs could be saved by replacing the dominant large suppliers with a number of smaller component suppliers. In fact, however, the big telcos have had the experience that managing a large number of suppliers is more likely to drive costs and focusing on one provider is ultimately cheaper.

StrandConsult had also already taken up the lack of European companies developing Open RAN technologies, which has now been presented by telcos, in its april report. An open standard per se does not contribute to more or faster innovation, nor does it guarantee that Europe’s influence can be strengthened. Instead, a dominance of Asian and US providers can still be seen.

In parts, however, the analysis of the Danes is almost provocative (see the website). The 10 most important theses are:

- Open RAN is not a technical standard.

- Open RAN is not suitable to replace Chinese technology in mobile networks.

- Open RAN lags behind the development of the 5G standard in terms of the speed of innovation

- Open RAN comes too late for the current development of 5G networks.

- Not Open RAN, but the restrictions on Huawei have opened the door for other providers – already active before Open RAN.

- The cost advantage of Open RAN on the part of individual components may be eliminated if all costs such as delivery, availability, energy consumption, security, warranty, network integration, device balancing, service level agreements, etc. Taken into account.

- Open RAN does not offer a security gain if the components of a (known) Chinese provider are exchanged for those of 50 (unknown) Chinese providers.

- Open RAN is less energy-efficient when standard Intel X86 CPUs are used instead of specialized, high-efficiency RAN chips, and the infrastructure consists of avariety of mix-and-match components instead of an end-to-end system.

- Rakuten is not an example of the success story of Open RAN, as Rakuten does not distribute an open but a proprietary solution (e.B. to 1&1 in Germany).

- Open RAN does not advance local ecosystems. Partly funded start-ups develop locally, but then have production in China.

Many proponents of the Open RAN concept relied on assumptions, expectations, and assumptions. On the other hand, there is a lack of verifiable facts and statistical evidence for the alleged advantages, criticizes the Report “Debunking 25 Myths of OpenRAN”. The Danes’ conclusion is therefore devastating: “OpenRAN is one of the most overrated technical solutions since the introduction of 3G in 2000.”

Appeal to our readers: Is Open RAN more of a bright spot or a legend for you?

Do you share the criticism of the Open RAN concept? Or do you see it more positively? Where do you see strengths, where weaknesses? And what would have to happen to eradicate existing problems and advance the development of Open RAN? We look forward to hearing from You at redaktion@fuenf-g.de!

Leave A Comment