India turns from underdog to frontrunner in 5G race in 2023 (Image: pexels)

Top global network companies and 5G infrastructure providers are rushing to enter the Indian 5G B2B and B2C market. With the subcontinent having established itself as the fastest-growing 5G landscape after China, companies like Nokia, Apple, and Airtel compete to meet the nation’s niche 5 G-related demands in 2023.

The fortnightly magazine, Business Today, lays into the following predictions: Namely, how cumulative 5G smartphone shipments will surpass the 100 million mark in the second quarter of 2023 and trump the demand for 4G smartphone shipments by the end of 2023. Furthermore, 5G is the third most important factor for future smartphone purchases, claims the publication.

5G Smartphones all the rage in 2023

According to Danny D’Cruze of Business Today, the share of 5G smartphones in lower price bands gradually increased, from 4% in 2021 to 14% in 2022, and is expected to reach 30% in 2023. The cost of an entry-level 5G smartphone dropped below approximately $122 in 2022, with the launch of the Lava Blaze 5G. Cheaper 5G chipsets from Qualcomm and MediaTek have allowed original equipment manufacturers (OEMs) to launch more 5G devices in the lower price segments, while the rollout of 5G services has also driven demand for these devices.

“India is one of Nokia’s top ten markets in terms of 5G business volume.”

Josh Aroner, Vice President, Global Customer Marketing, at Nokia

Playing a pivotal role in all these predictions, is the humble South Asian country, India. A new study by Counterpoint Research, a global industry analysis firm headquartered in Hong Kong, suggests that in India, 5G technology is expected to drive demand for smartphones in 2023. In fact, India’s 5G smartphone shipments are estimated to grow 81% year-over-year in 2022, due to the expanding presence of 5G connectivity in lower price bands and the rollout of 5G networks in the second half of the year.

Indian market hotspot for 5G service providers

Whilst international companies are rushing to enter the South-Asian market, to meet the developing countries’ newly found demand for 5G infrastructure and goods, the subcontinent’s politics too is driving new policies to help smoothly guide the transition from 4G to 5G. Reuters.com reports, that India’s government has already begun to push Apple, Samsung, and other mobile phone manufacturers to prioritise rolling out software upgrades to support 5G in the country. Amidst concerns that many of their models are not ready for the recently launched high-speed service. India’s Prime Minister Narendra Modi launched 5G services on Oct. 1. 2022, with leading telecom operator Reliance Jio.

Subcontinent calls for 5G compatible software

Online Tech-News portal BGR.in writes: India’s launch of 5G in the world’s biggest mobile market – after China – will bring high-speed internet to consumers, with simultaneous socio-economic benefits in sectors like agriculture and health. In August 2022, Jio, India’s biggest mobile carrier with more than 420 million customers, snapped up airwaves worth $11 billion in a $19 billion 5G spectrum auction.

Airtel, on the other hand, spent more than $5 billion, while Vodafone doled out above $2 billion. Sources from Apple have already declared, the initiation of testing and validating different 5G offerings from network providers in India. While telecom players and smartphone companies have been holding discussions with each other, ironing out compatibility issues between the specific 5G technology of telecom companies in India and phone software is taking time, one of the industry sources said.

“There is a unique alignment in the Indian market, where operators and the government are working together. Indian customers are also super enthusiastic about 5G services.”

Josh Aroner, Vice President, Global Customer Marketing, at Nokia

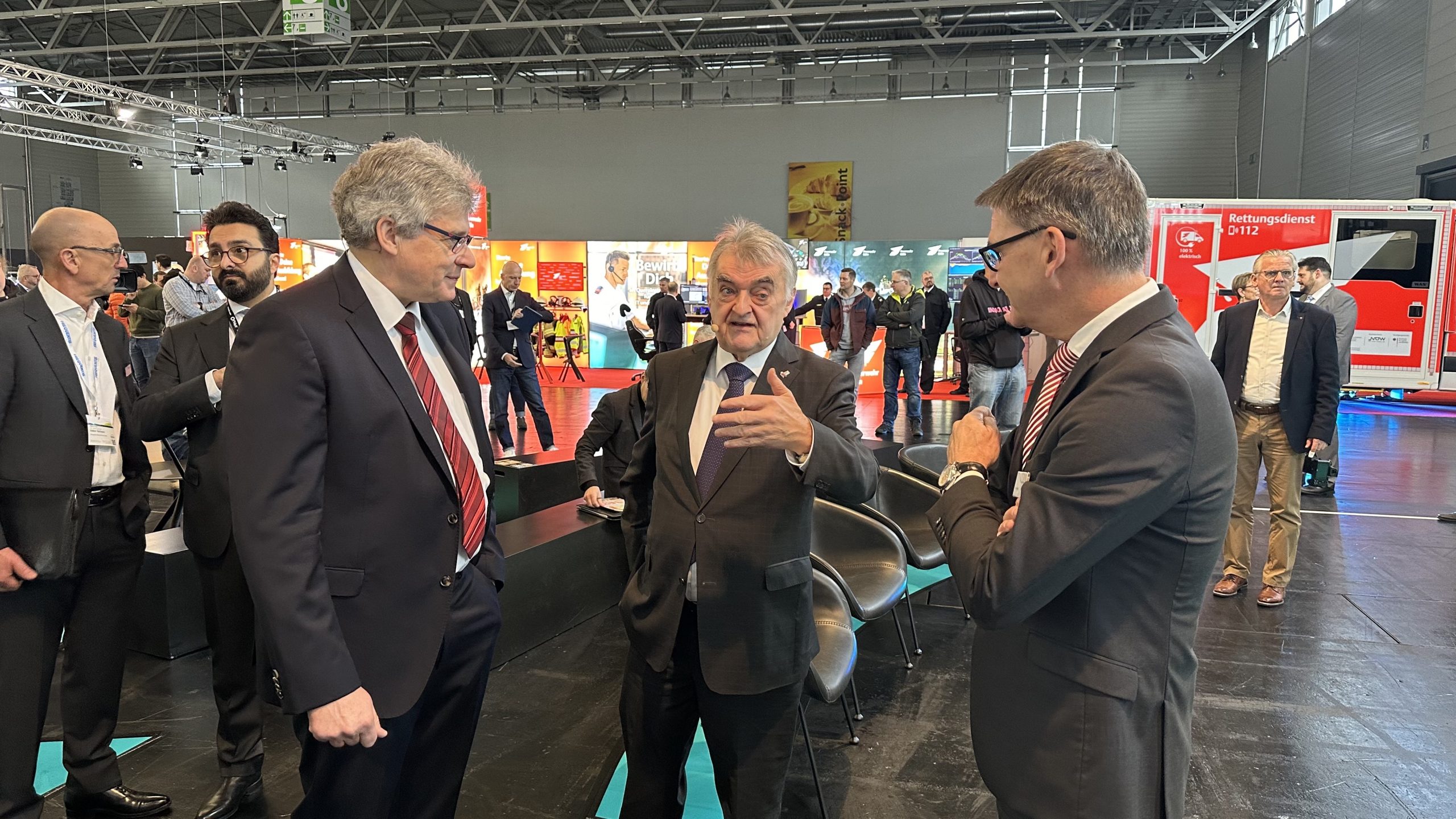

Nokia’s 5G link with India

“India is one of Nokia’s top ten markets in terms of 5G business volume,” says Josh Aroner, Vice President, Global Customer Marketing, at Nokia. Speaking with businessline on the sidelines, post the 2022 India Mobile Congress. Aroner further noted that the country will see larger benefits from the recently commenced 5G rollout if the industry is able to transition to business-to-business applications of 5G faster.

Nokia too has deployed 500 private networks worldwide, 20 percent of those networks are on 5G. Only recently, Nokia was selected by the India’s Bharti Airtel for 5G deployment. Nokia and Airtel have signed a multi-year agreement to deploy Nokia’s SRAN solution across 9 circles in India, helping Airtel to enhance the network capacity of its networks, in particular 4G. The rollout, recently completed in 2022, has laid the foundation for providing 5G connectivity in the future. It will see approximately 3,00,000 radio units deployed across several spectrum bands, including 900 Mhz, 1800 Mhz, 2100 Mhz and 2300 Mhz.

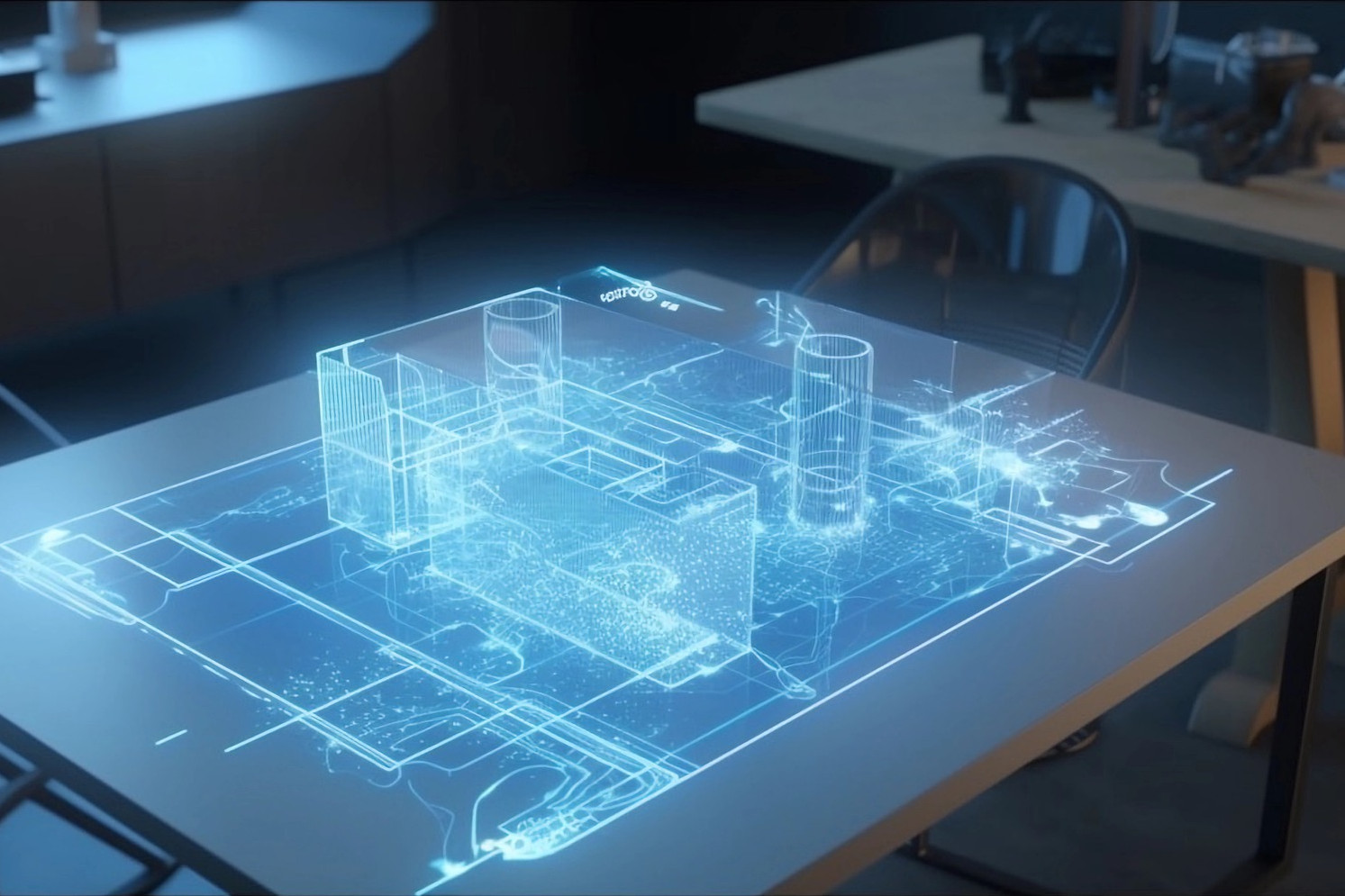

Conclusion: Operators and government hand-in-hand for 5G

5G opens a new area of connectivity where the industry can use its capabilities to drive digitisation into every aspect of business operations. With technologies such as private networks, and edge computing. Aroner told businessline that, 5G will drive investment into digitisation from businesses that usually do not spend much on building digital capabilities. “The majority of digital investments will come from companies with physical assets, more traditional industries, rather than more technology-focused companies”, concluded Aroner.

“There is a unique alignment in the Indian market, where operators and the government are working together. Indian customers are also super enthusiastic about 5G services,” Aroner explained. He also noted that the Indian market is also familiar with the variety of B2B use cases of 5G and added that once 5G for enterprises is made available, the deployment of enterprise applications will occur very quickly.

As the capital expenditure for 5G commences, India is emerging to be the second-largest market for telecom in the world. Aroner noted that Indian industry is also uniquely suited for enterprise applications since it is younger than the western markets. “Indian industry has already accepted digitisation which could facilitate enterprise applications of 5G in the future,” Aroner concluded.

Leave A Comment