There is a dispute among network providers in Germany. 1&1 complains, a Vodafone subsidiary does not meet the agreed rollout targets for 1&1’s 5G network. The true reason could be, that the powerful provider wants to make it more difficult for the smaller rival to access further frequencies precisely with this fact, so the suspicion. Now the Bundeskartellamt is to examine whether a targeted strategy distorts competition.

1&1 had caused a sensation in 2019, when it had positioned itself as the fourth mobile phone provider. In addition to Internet access, the Montabaur-based company has so far also marketed mobile phone contracts, but only as a reseller of the networks of Deutsche Telekom, Vodafone and Telefónica/O2.

As a successful bidder in the last frequency auction, which mainly involved additional bandwidth for the introduction of 5G, 1&1 has committed itself to build its own radio network in fixed stages. The first expansion target was to put 1,000 antenna sites into operation by the end of 2022. By the end of 2025, 1&1’s network must be expanded to such an extent that at least 25 percent of the population has reception at home in the 3.6 GHz band.

First warnings still cautious

In September of last year, 1&1 announced that the mandatory rollout target could not be achieved by the end of the year, but with a half-year delay. And this despite intensive efforts to accelerate further expansion through accompanying measures. A total of three partners were involved in the rollout. Two of whom had delivered in accordance with the contract, but the third “surprisingly” did not meet its obligations on time. The mobile phone company did not publish names at that time.

A few weeks later, those responsible in Montabaur spoke plainly and disclosed with whom they were working on network construction. These are ATC (American Tower), GfTD and Vantage Towers, whose largest owner is the 1&1 competitor Vodafone. At the same time, Vantage Towers is also the partner with the largest order volume “by far”. As the company confirmed, at least 3,800 antenna sites should be created for 1&1 by the end of 2025, with the contract including an option to expand to 5,000 sites. They affirmed to hold on to this goal.

Rollout situation escalates

Recently, 1&1 announced that in a joint meeting with Vantage Towers and Vodafone, the rollout plan updated at the end of 2022 was withdrawn once more. Those for the first half of 2023 would again be clearly missed. In its communication, 1&1 accuses Vodafone of influencing Vantage Towers in order to expand the activities in favour of Vodafone – at the expense of 1&1.

These delays have consequences that put 1&1 in ever greater difficulties. This starts with the selection of antenna locations, where places for the 1&1 technology are now blocked by Vodafone installations and sometimes new masts have to be created, which experience has shown to be very time-consuming. On the other hand, the launch of the 1&1 network in autumn 2023 will now be endangered, as some of the necessary technical certification processes can only be carried out when a minimum number of antenna sites are in operation. With the start of the network, the conversion of 1&1 customers, who have so far been switched to other networks, should also begin. They would be routed to the Telefónica/O2 network via roaming in areas where 1&1 does not yet offer coverage.

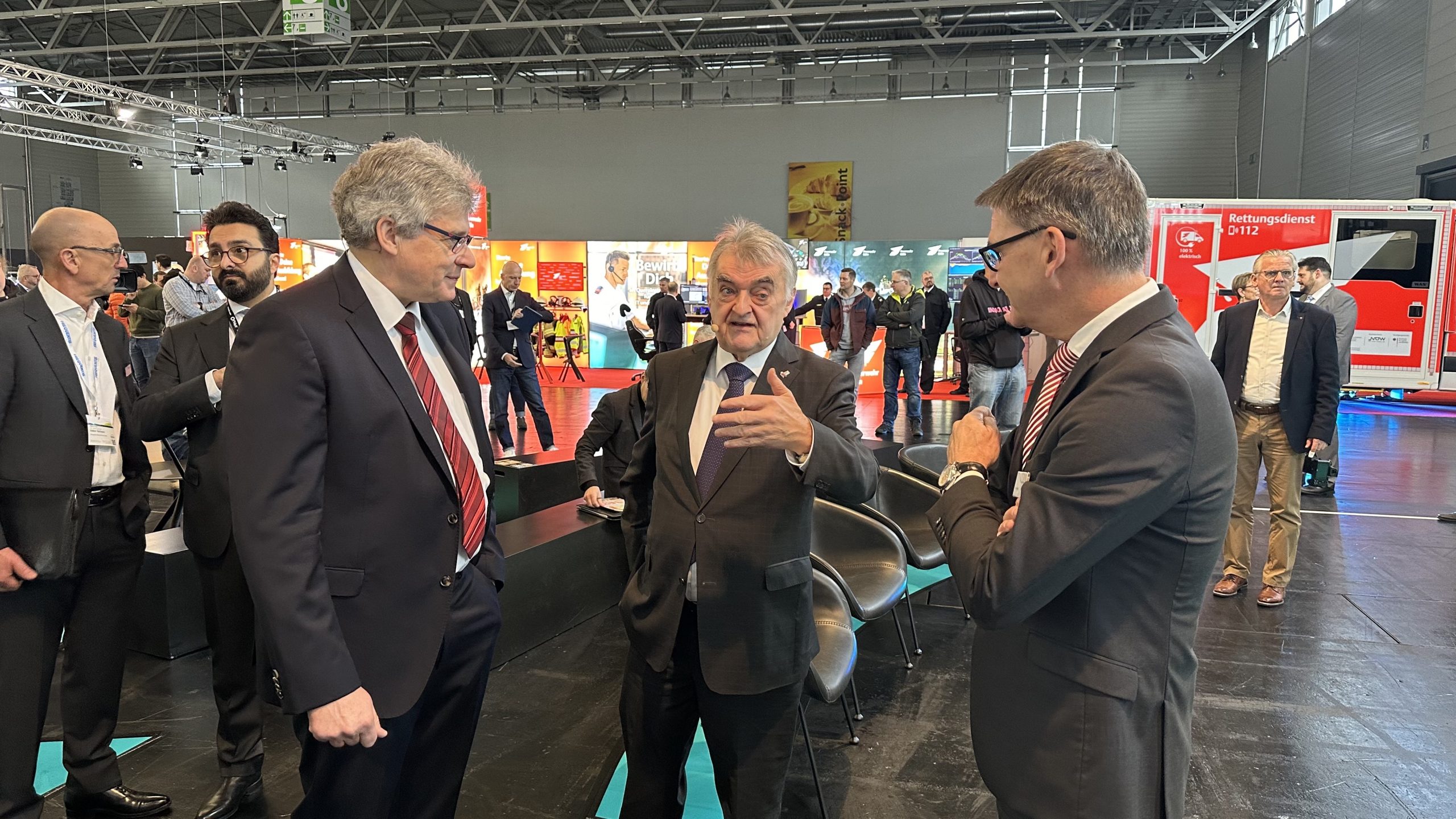

1&1 CEO Ralph Dommermuth has linked the future of the Group with its success as a network operator. (Source: United Internet)

However, 1&1 managers are likely to have been particularly enraged by Vodafone’s attempt to boot out the new competitor in the upcoming licensing. In focus are frequencies below 1 GHz, which are indispensable for network construction outside urban regions due to the favorable physical propagation properties. Here, a new allocation from 2026 is pending, but the blocks are so small that a meaningful distribution to four network operators does not seem possible. The Federal Network Agency is in talks with Deutsche Telekom, Vodafone, Telefónica/O2 and 1&1 to explore alternatives to another expensive bidding. In this context, Vodafone probably suggested that the network newcomer should not be taken into account in view of the sluggish network rollout; Deutsche Telekom agreed.

1&1 countered with public accusations that Vodafone deliberately hindered the expansion of the fourth 5G network, which the Düsseldorf-based mobile phone group immediately rejected. In addition, the team around 1&1 founder Ralph Dommermuth has filed a formal complaint against Vodafone with the Federal Cartel Office in order to have the allegations investigated.

Avoidance strategy?

Industry experts point out that 1&1’s complaint may not only be aimed at putting pressure on Vantage Towers to accelerate the expansion of 1&1 antenna sites. But that it could also be about averting an impending fine from the Federal Network Agency (BNetzA) because of the missed rollout targets by presenting a culprit outside the 1&1 group of companies in advance.

But there is also a threat of other adversity from the side: Last October, the BNetzA announced a date for the end of the previous dual role of 1&1. Accordingly, the mobile phone group must discontinue the sale of mobile phone contracts for third-party networks at the end of 2023. Existing mobile phone contracts must be converted to the company’s own network or terminated by the end of 2025. In this respect, 1&1 is under considerable pressure to get its network up and running.

[/fusion_text][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]

Leave A Comment