After the initial euphoria, the new 5G standard had to battle with a number of problems at the start, which inhibited its use in the manufacturing and process industries. In the meantime, the situation has completely turned around. 5G campus networks are on the rise, and the results from the field are positive. Private mobile networks are proving their worth in terms of digitization of processes and business models as well as efficiency and return on investment (RoI).

The launch of 5G in 2019 was associated with tremendous expectations. This is because the new mobile communications standard was explicitly not designed as a further development of telephony, but as a data transmission standard for industry and other professional users. 5G was to integrate numerous technologies, or at least make them accessible, geared to the requirements of production facilities, transport companies and logisticians, the healthcare sector, and other industries. This was also to enable dedicated campus networks.

But the start was jerky. Routers suitable for industry were hardly available, there was a lack of internal and external expertise, and the solutions were initially so expensive that the investments hardly paid off. One of the reasons for this was that the installed solutions were usually highly complex and extremely individual what prevented scalability. Integration into existing networks also proved to be complex. All this contributed to the fact that the development of the 5G market was significantly slower than expected by market analysts and mobile network providers.

There is no longer any question of that today. Numerous providers have discovered the 5G market for themselves and offer a wealth of predefined solutions that cover highly diverse requirements. For example, 5G installations “out of the box” and cloud-based campus networks have lowered both the technical barriers to entry and the costs required for a pilot installation. In addition, the integration and administration of 5G campus networks into enterprise network management is much easier thanks to adapted tools and applications.

For example, it is now actually no longer a problem for companies to have their own private 5G mobile network that functions independently of public mobile networks and is therefore not dependent on the regional expansion status of telephone networks. Thanks to standardized solutions that are less complex to set up and operate, as well as reduced capital expenditure and lower operational costs, even small and medium-sized enterprises can now use their own private 5G networks economically.

Diverse offers

Interested users can choose from an increasingly growing crowd of suppliers and service providers who support them in designing, building and operating 5G campus networks. 5G pioneers such as Nokia and Ericsson have found their way to users together with partners, as have the three major German mobile network operators, Deutsche Telekom, Vodafone and Telefónica/O2. In addition, more and more industry, network and IT service providers are building up expertise in the 5G field and can already point to practical experience from their projects.

In the enterprise sector, for example, Axians, NTT, Verizon and Xantaro are worthy of mention, while more medium-sized customers are addressed by Becom, Cocus, MECSware and RSConnect, among others. IT giants and hyperscalers such as Microsoft and AWS, HP and IBM have also embraced the topic and integrated private 5G campus networks into their network solutions. Similarly, edge computing vendors, including Dell, QCT and VMware, for example, point to the benefits of their solutions in the industrial manufacturing environment when they have high-speed 5G network connectivity. In the U.S., specialized 5G startups are already vying for enterprise customers. And last but not least, industrial equipment and machinery manufacturers such as Arburg, Grenzebach, Kuka, Siemens and several more are continuously introducing innovative solutions that facilitate the development of 5G-enabled applications.

In building up their own competencies, industrial companies can also benefit from the work of associations. For example, the 5G-ACIA (5G Alliance for Connected Industries and Automation), a working group of the ZVEI, which is responsible for knowledge transfer, the definition of testbeds and the dissemination of interesting use cases, and the ZVEI Academy.

Rising numbers of campus networks

To support industry in the deployment of 5G camppus networks, the German government has reserved 100 MHz of the available spectrum for exclusive use on company premises (indoor and outdoor). To use it, companies need a license from the Federal Network Agency (BNetzA). The application process is not too complex, and is often handled by IT and network partners as part of a project. The fees are also not very high. The (german) 5G campus license cost calculator from FUENF-G gives you an overview of the fees involved in just a few minutes. All you have to do is enter the size and type of area, the desired bandwidth and the duration of use in the downloaded Excel sheet.

In January last year, the BNetzA reported 186 licenses issued; by mid-November 2022, the number had risen to 265, and by August 15, 2023, the figure had already reached 341. This represents an increase of almost 30 percent in the past nine months alone. Similar trends are evident around the world. The February 2023 GSA report “Private-Mobile Networks” lists over 120 new campus network projects in Q4/2022, taking into account both 4G and 5G networks.

For the year as a whole, the figures add up to 1,077 private networks. These are primarily to be found where dedicated spectrum is available to companies. While LTE still dominates the portfolio, the proportion of projects that (also) use 5G technology is 55 percent among the 122 new announcements in the last quarter of 2022, according to the GSM Supplier Association (GSA). This means that the current mobile communications standard is predominant for the first time.

Experiences from practice

The question of what motivates companies to now increasingly consider 5G in networking is exciting. Away from the rising numbers of vendors and predefined solutions that are generating interest and driving the 5G market, users are increasingly seeing the opportunity to achieve concrete operational and strategic goals.

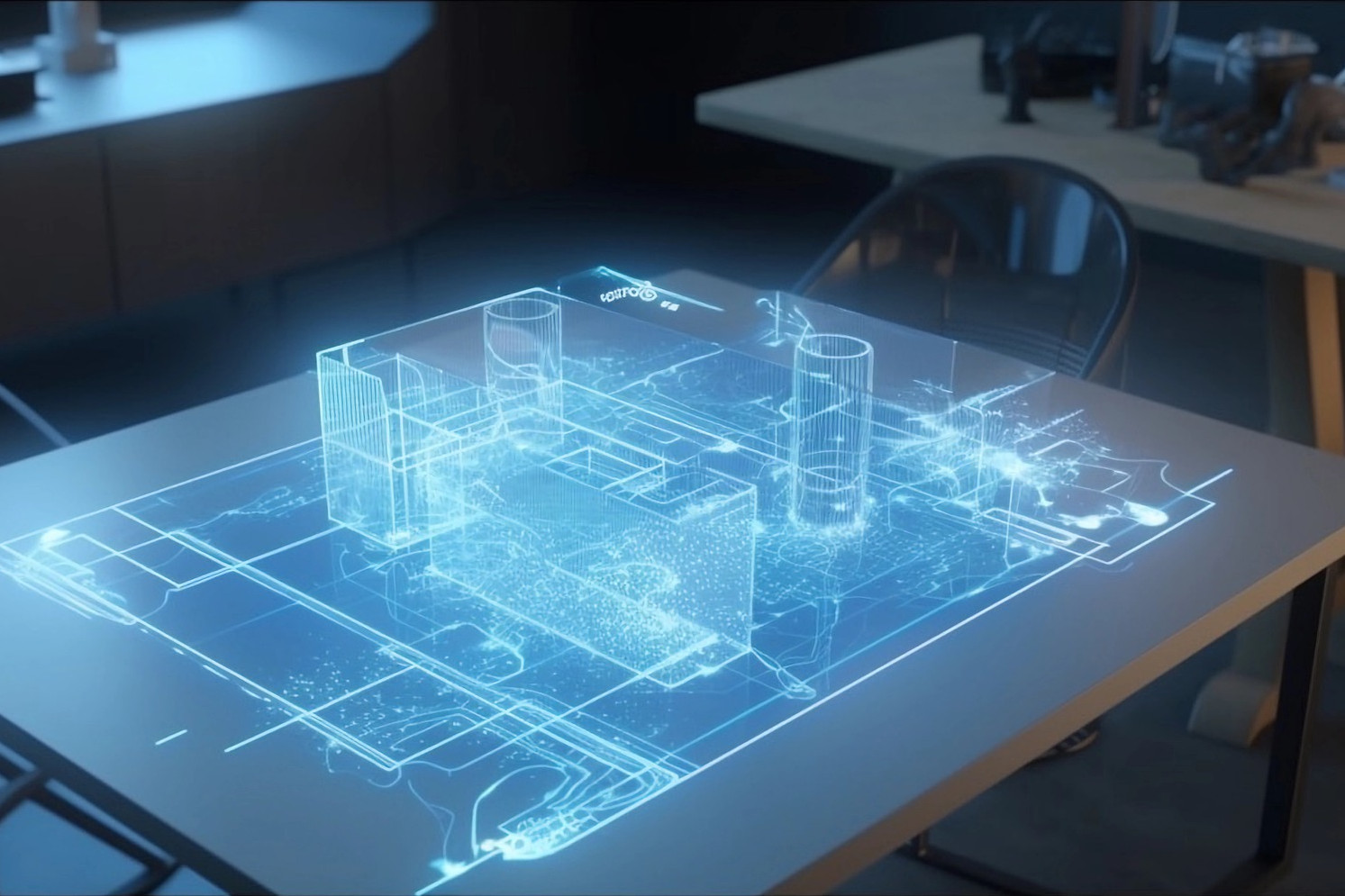

What is striking is the breadth of applications now covered by private 5G campus networks. These range from cutting-edge applications such as remote maintenance and control, digital twins, asset tracking and virtual reality offerings to real-world applications such as robotics, automation, connected vehicles, video surveillance and infrastructure monitoring. Companies primarily cite improved radio coverage, high speeds, low latency, and the ability to transmit large amounts of data in real time as advantages of the new wireless standard that were relevant to the decision.

Supporting general digitization efforts is also frequently cited. According to a survey by Nokia and GlobalData, many companies believe that private networks, combined with the digital transformation of on-premise edge, devices and applications, will help them to be more competitive and achieve their security, operational and sustainability goals. The majority of them show openness to using digitization to leverage external services from market leaders and digital ecosystem providers. At the same time, they expect an increased return on investment (RoI) based on campus networks.

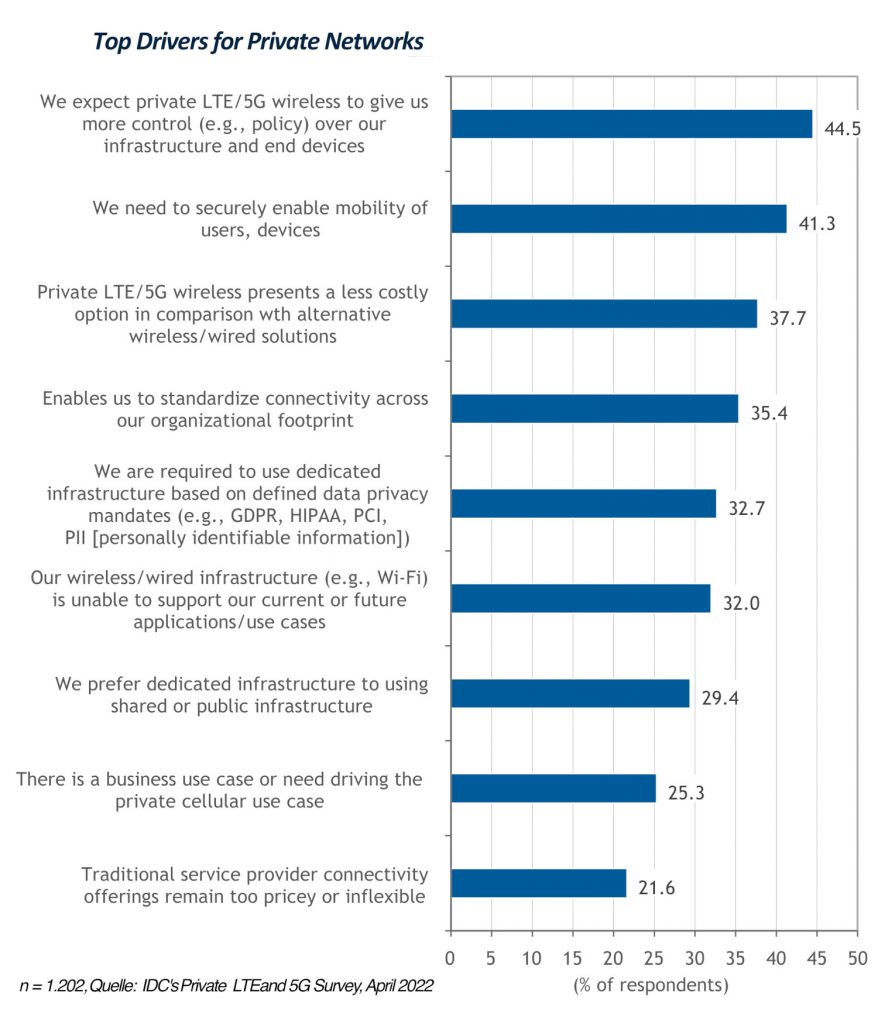

A study by IDC in April 2022 came to similar conclusions. The market researchers surveyed more than 1,000 decision-makers worldwide on the most important reasons for deploying 5G campus networks. Details from the report “Emerging Opportunities for 5G Private Networks”, can be seen in the following table.

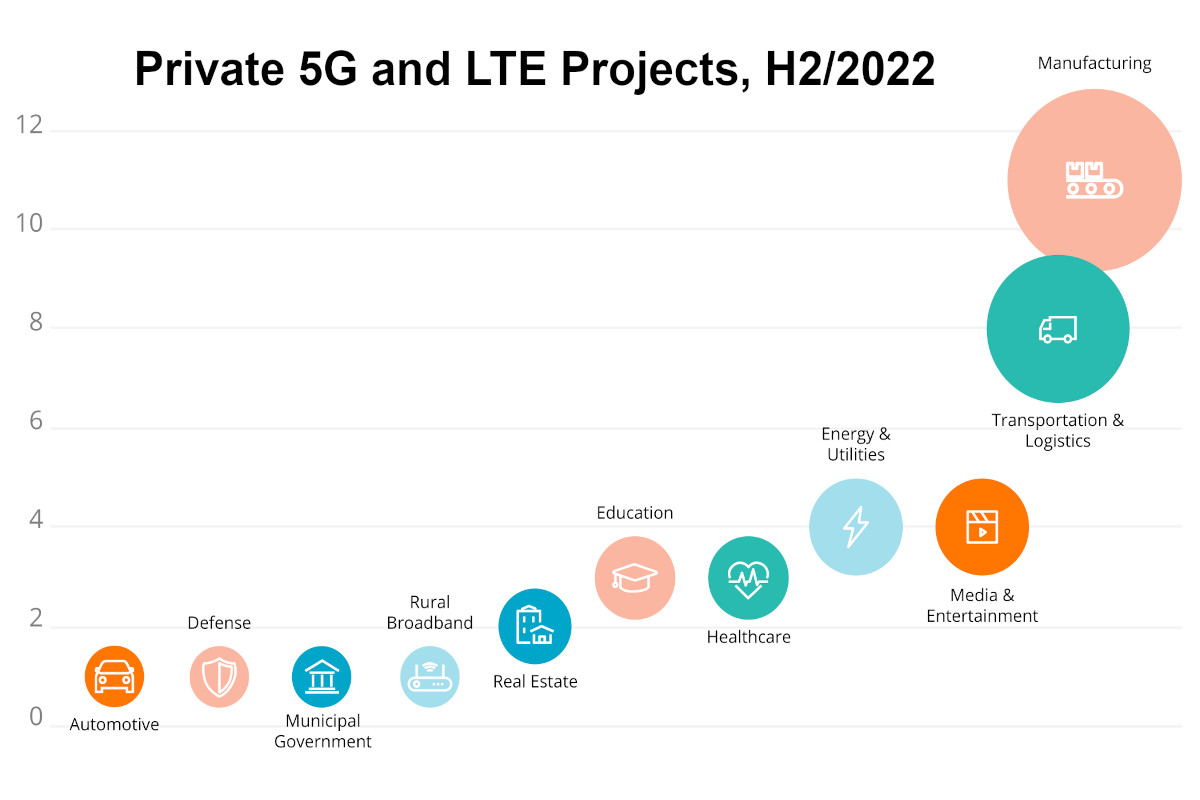

Looking at the industries where 5G campus networks are being deployed, industrial manufacturing is at the forefront, followed by transportation and logistics, energy and utilities, and media and entertainment, according to the report “State Of The Private LTE & 5G”. But government agencies and administrations, as well as public sector companies, are also increasingly recognizing the benefits of a 5G campus network.

Countable success

Decision-makers in 79 multinational companies who were early adopters of private wireless digitization solutions in the manufacturing, energy and transportation sectors were surveyed for this analysis. Over 50 percent reported that their TCO had improved by six percent or more as a result. For 29 percent, the TCO improvement was even more than 10 percent.

An important factor in improving efficiency is faster and broader access to sensor data, which leads to improved data analyses – partly also based on AI applications on edge servers close to production – and subsequently to more efficient production processes. This is also accompanied by greater agility in production, as adjustments can be made more quickly. It can also increase operational reliability. Progress of 10 percent or more can be achieved in a number of metrics, and improvements of more than 20 percent are often achieved in energy consumption and reduced downtime.

Almost 80 percent of those surveyed already have industrial edge solutions in use or are planning them. Typically this involves business-critical use cases in the area of Industry 4.0 that require local data processing with low latency. For reasons of data security and sovereignty, companies tend to opt for a private network rather than solutions based on public networks of major mobile network providers. WLAN, on the other hand, is mostly used only for IT services and non-business-critical functions.

Campus networks increasingly attractive

Of course, not all that glitters is gold with 5G. In some cases, the operating costs are still comparatively high – despite the progress that has been made. Here, a profitability calculation must show whether the expected progress justifies the investments. However, the offerings are increasingly becoming mainstream, which is accompanied by a larger competitive field and falling prices. At the same time, the entry threshold is also falling in terms of the expertise required.

Developments over the past twelve months in particular show that the use of 5G campus networks is bringing measurable benefits for more and more users. When the 5G Release 16, which promises more performance at lower prices, is introduced for the receiving equipment at the beginning of 2024, this trend will increase significantly.

Leave A Comment