Investments in automation, IIoT and infrastructure are also driving demand for 4G/5G technology. (Source: Nokia/ABI Research study)

Using the crisis to prepare for the future. This is currently the motto in many companies. Investments in the infrastructure also play a major role. It will be interesting to see what proportion of this will be accounted for by investments in 5G. A study now shows what plans industry decision-makers had for 5G shortly before the outbreak of the corona pandemic.

One result of the study is clear: Decision-makers across all sectors and industrial nations are planning to upgrade their communications and control networks over the next two years–at least that was the core message of a study by Nokia and ABI Research, which was executed at the end of last year and which results have now been published. The just over 600 respondents came in roughly equal numbers from the three major sectors of the automotive, mechanical engineering and consumer goods industries.

The results show that 74% of respondents planned to upgrade their communication and control networks by the end of 2022. More than 90% wanted to investigate the use of 4G and/or 5G mobile communications in their operations. Just over half of those surveyed (52%) said that the latest generation of mobile communications technology (4G/LTE or 5G) would be required to achieve their transformation goals.

Investment in digital infrastructure

Those companies planning to invest in 4G or 5G mainly want to digitalize and improve the existing infrastructure (63%), use robotics to drive automation (51%) and increase employee productivity (42%).

“The need for industrial-grade wireless networks combined with the availability of easy-to-implement private campus networks will lead to rapid deployment.”

Manish Gulyani, Vice President Marketing at Nokia Enterprise

Commenting on the results, Manish Gulyani, Vice President of Marketing at Nokia Enterprise, said: “We have reached a turning point in the transformation towards Industry 4.0 because the fast and secure connectivity required for it is now available. The research shows the huge need for industrial-grade wireless networks to take advantage of the transformative benefits of digitalization and automation. Combined with the availability of easy-to-implement private campus networks, we believe this need will lead to rapid deployment.”

The study analysed the short-term factors influencing investment decisions for new industrial systems–in the areas of IT (information technology) and OT (operational technology, i.e. technology for controlling production processes). The IT drivers are primarily the reduction of downtime (53%), improvement of operational efficiency (42%) and security (36%). OT drivers are motivated by the desire to replace obsolete infrastructure (43%), improve efficiency (40%) and increase capacity (38%).

Further interesting results are:

- 88% of respondents say they are already familiar with 4G/5G campus networks

- 84% of those considering 4G/5G favour having their own local campus network in their production facilities

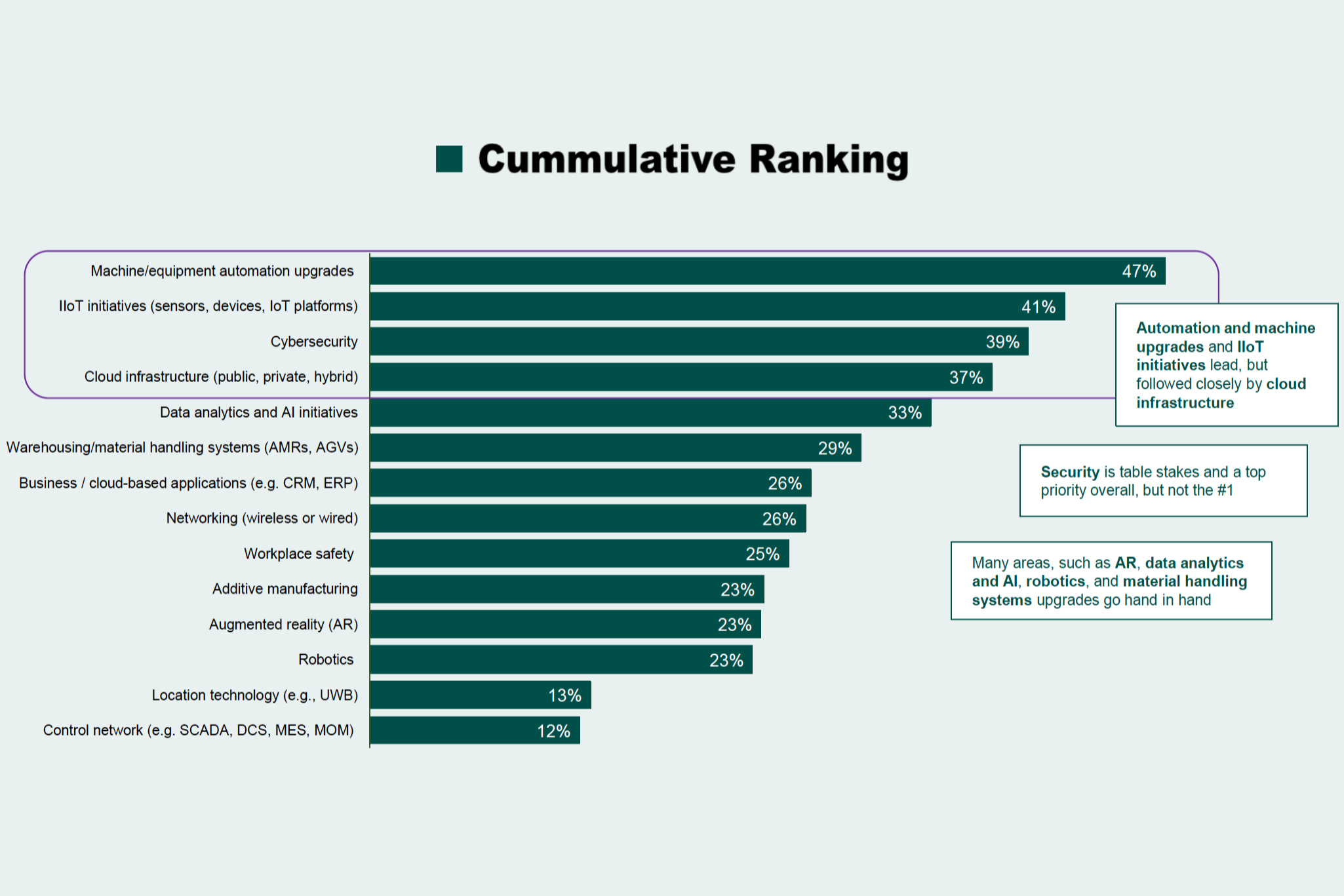

- Priority investment areas are automation and modernisation of machinery (47%), IIoT initiatives (42%), followed by cloud infrastructure (37%)

4G/5G a major topic for German industry

If we look at the answers of the respondents in Germany, a similar picture emerges: Also in this country, about three quarters of the decision-makers are concerned with the use of 4G/5G in manufacturing. A further 15 % focus on 5G. As the most important applications that could be supported by 4G or 5G, 22 % of those surveyed name the digitalization of existing systems and machines, 17 % the topic of security/surveillance. When asked about the reasons for investing in industrial systems, 60% of respondents cited reducing machine downtime as the most important factor of IT. In the area of Operational Technology (OT), improvements in quality and efficiency are primarily seen as investment drivers, with 38 % each. In a country comparison, security (31 %) is particularly important for the participants from Germany.

“The respondents do not want to commit to Wi-Fi/WLAN and are instead considering the latest wireless technologies.”

Ryan Martin, author of the study

While experts see the systems of the future as a coexistence of different wireless technologies, only 20% of respondents believe that Wi-Fi 6 (802.1ax) will meet future requirements. Ryan Martin, Principal Analyst at ABI Research, said: “Importantly, the results show that industrial companies have a preference for wireless campus networks that are fully owned and operated by them. Companies prefer to manage them in-house to reduce security concerns. Respondents appear to be reluctant to commit fully to Wi-Fi/WLAN and are considering the latest wireless technologies. As a result, 2020 is a critical year for network manufacturers to educate the market about the benefits of 4G/LTE and 5G.

On the basis of this study, the authors also see the need for the entire industry to not only quantify the potential return on investment of investments in private wireless technology, but also to clearly identify the costs of doing nothing. Network equipment vendors should speak out in favor of investing in Industry 4.0 today to have a clear competitive advantage over those who choose to wait.

Respondent data: 602 individual respondents with different decision-making powers in the following sectors: Automotive (201), consumer goods (201) and mechanical engineering (200). Geographic distribution of respondents: USA (161), Germany (100), Japan (100), China (40), India (40), Australia (40), United Kingdom (41), Canada (40) and France (40). The survey was completed at the end of 2019, before the outbreak of the Covid 19 pandemic.

Here you can view a short version of the study.

Leave A Comment