After the US, Huawei’s business is becoming increasingly difficult in Europe as well. (Source: geralt, QuinceCreative / Pixabay)

While the Chinese manufacturer will probably be forced out of the market for good in the U.S., Huawei announces a restructuring in Europe. Allegedly, “the effectiveness is to be improved”. The bloodletting among PR managers and lobbyists speaks a clear language: Hardly anyone in the company expects the business outlook to brighten up fundamentally again.

For around five years, the U.S. has been fighting against the use of Chinese technology in mobile communications – both on its own market and among its allies in the European Union and the G7 countries. The former U.S. President Donald Trump had first imposed strict sanctions on ZTE, then also on Huawei. His successor, Joe Biden, continued the course and issued further restrictions at the beginning of the year.

The responsible US telecommunications regulator, FCC, has now confirmed these. Communication devices and network technology from Huawei and ZTE posed an unacceptable risk to national security. They may therefore no longer be imported into or sold in the USA. There is even the possibility of revoking licenses that have already been granted, confirmed FCC Commissioner Brandon Carr.

Even though the U.S. government has not yet been able to present any concrete evidence of possible misconduct or technical risks, such as backdoors, it assumes that in the event of a political conflict, the technology of the Chinese manufacturers could be misused for espionage and sabotage purposes on the orders of the rulers in Beijing.

Rethinking in Germany

German politics was divided from the start, while other European countries joined the hard U.S. line, partly under massive pressure from the White House. Although there were considerable voices in the Bundestag in favor of a strict course against Huawei & Co. the Merkel government relied on waxy formulations that left considerable room for interpretation and ultimately did not prevent the use of Huawei technology. Only flanking measures were taken, such as the promotion of open RAN developments to create favorable alternatives.

Deutsche Telekom and Vodafone had also made their contribution to the cautious positioning of German policy. They pointed out that a fast 5G rollout is only possible if Huawei’s existing 4G technology is simply allowed to be supplemented. If, on the other hand, they had had to replace the Chinese manufacturer’s components, this would not only cost them billions, but would have set back the expansion timetables by years.

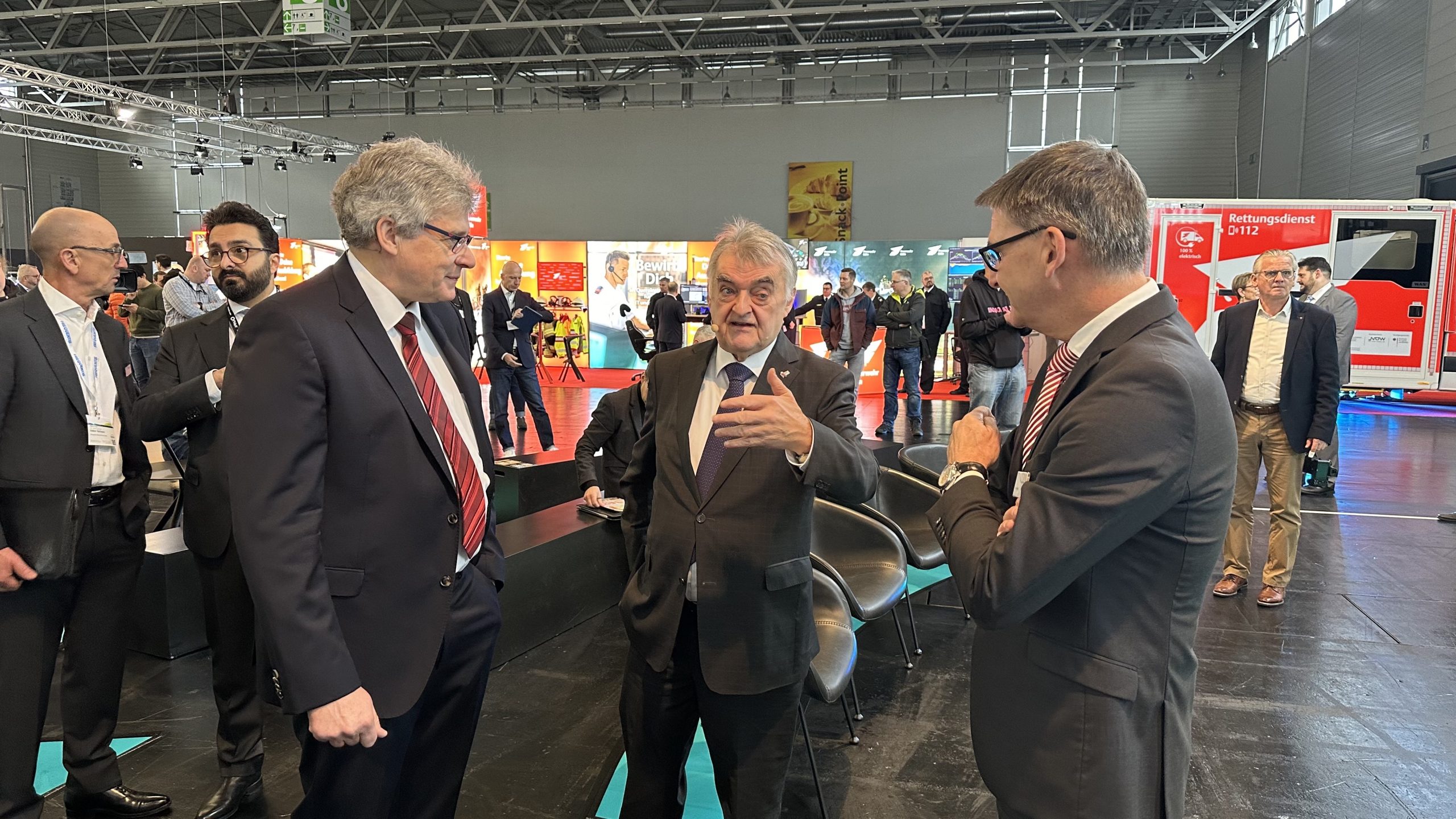

In light of the Ukraine war, however, the current government has reassessed dependencies on foreign suppliers. As early as the end of July, the German Interior Ministry threatened to tighten the reins and prohibit the four German network operators from using “critical components” from Chinese manufacturers (Fuenf-G.de reported). In October, the EU had ramped up pressure on governments in Germany, Spain and elsewhere, calling for “immediate action” to secure 5G networks. Where this has not yet been done, restrictions on high-risk suppliers should now be enacted, the EU Commission demanded. Now, three ministries at once are working to clarify the situation. For example, both Foreign Minister Annalena Baerbock and Economics Minister Robert Habeck are preparing a China strategy to break free from existing dependencies. And Interior Minister Nancy Faeser announced a new law on the protection of critical infrastructure (“KRITIS”), which is also likely to have an impact on the business of Chinese technology suppliers.

This is also likely to be unpalatable to mobile operators. Although Vodafone and Telefónica say they have now largely banned Huawei from their core networks, they therefore see the remaining residual risk of outside hacking as minor. Deutsche Telekom, on the other hand, has not yet fully implemented its plans to convert its core networks. And all three still use Huawei technology to a significant extent in their access networks.

Huawei restructures

In parallel, Huawei announces it is restructuring its operations in Europe. Two separate sales organizations will become one, giving the Düsseldorf location more responsibility. At the same time, some offices and branches are to be closed. This includes the Brussels location – the lobby work in the European committees will also be managed from Germany in the future.

The US political magazine Politico, on the other hand, classifies Huawei’s announcements as a strategic withdrawal from Europe. This is supported, for example, by the statement of an anonymous high-ranking insider, according to which it is no longer a matter of advancing globalization, but rather the company is merely anxious to “save its ass”. Politico also reports that numerous PR and lobby managers have left the company, citing a number of examples. The magazine concludes, “When it comes to the big European game, Huawei has lost – and sent all its political players home.”

Comment: Give in, but don’t give up

When Huawei responds to journalists’ inquiries by saying that its headcount in Europe remains stable and that its media and lobbying departures are within the natural fluctuation of a large company, you can believe it – or not, until proven otherwise.

So far, Huawei has still been able to hold its own in some European countries. Large markets like Germany, Spain, and Italy, as well as smaller countries like Switzerland and Hungary, largely let the Chinese manufacturer have its way. Now the air is getting thinner everywhere, and for several reasons.

The Russian invasion of Ukraine is not limited to the territory of the two states directly involved. The potential for blackmail through the failure to deliver or sharply increased cost of energy supplies, physical and digital attacks on energy, financial and logistics companies in Europe provide evidence of hybrid warfare. They are leading to a reassessment of critical infrastructure security, as is the Chinese government’s increasingly blatant claim to power.

A company that would not adapt to this new situation would be foolish. That’s why I think it’s likely that the strategy will now no longer focus on offensive PR work, which would tend to incite political conflicts. On the one hand, the strategy is to maintain existing customer relationships by continuing to provide the necessary resources and deliver what is still permitted and required. Otherwise, however, it is more likely to aim to fly “under the radar” in terms of public perception and – possibly – to hibernate in the hope of a more favorable political climate. But that is likely to be ruled out for many years, similar to the case of Russian energy companies.

Harry Jacob, Editor FUENF-G.de

Leave A Comment