1&1 is preparing to set up a fourth German mobile network – but with a delay. (Source: 1&1)

By the end of the year, 1&1 should have built at least 1,000 antenna sites for its new 5G mobile network. But this target is no longer achievable, the group now admitted, citing supply bottlenecks. The market launch of 5G services is still scheduled for mid-2023 as planned.

At the 2019 frequency auction, the communications group 1&1 was able to secure its own frequencies in order to set up a fourth mobile network – in addition to those of Deutsche Telekom, Vodafone and Telefónica / O2. But the purchase was subject to conditions: 1,000 5G antenna sites were to go into operation by the end of 2022, and the mobile network must reach at least 25 percent of the German population by 2025, and even 50 percent by 2030.

However, the company will fail to clear the first hurdle, as 1&1 has now announced. Of the three expansion partners, two could deliver as agreed. However, they are only responsible for around one third of the planned 1,000 sites. The third partner, on the other hand, who was to take on the rest, is unable to meet its obligations on time. After intensive talks, the expansion partner had tried to implement various acceleration measures. However, these also failed. The expansion target is therefore not expected to be reached until summer 2023.

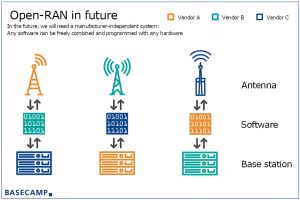

Pure Open RAN Infrastructure

The general contractor for the network rollout is Rakuten Symphony, the mobile communications division of the Japanese group. The latter is fully committed to an open RAN architecture, i.e., an infrastructure that uses different providers and connects the various components on the basis of open standards.

Rakuten has already used this method to build a mobile network in its home country – but with mixed success. According to market experts, savings of 30 to 40 percent can be achieved in purchasing compared to proprietary solutions from a single source. On the other hand, high expenses are still being incurred for interoperability tests – the Japanese Rakuten network is expected to cost almost twice as much as the originally estimated EUR 4.8 billion.

There are also said to have been initial problems with the performance of the network. But the company has learned from its experiences in Japan, says Raimund Winkler, head of Rakuten Mobile Germany. That’s why “Rakuten 2.0” is at the start in this country. This seems to be paying off: A few weeks ago, 1&1 reported that the first field tests had been successfully completed.

“In July, we launched the first Friendly User Test under real conditions and in real customer behavior! The results met our predictions and in some cases even exceeded them.”

Company spokesperson 1&1

Speeds of over 1 gigabit per second were achieved, as well as stable data transfers of around 8 terabytes per customer within 24 hours. Under optimal conditions, latency times of less than 3 ms are possible, for example for gaming applications in the edge cloud.

Competition not idle

The other three mobile providers are also experimenting with Open-RAN infrastructures. Telefónica, however, is limiting itself to complementary infrastructures for areas with a high density of users, for example in the centers of large cities. It is questionable whether the technology is suitable for a nationwide rollout, according to Jochen Bockfeld, Vice President Network Core & Service at Telefónica Germany. Vodafone, meanwhile, is developing its own chips and hardware for Open-RAN. And Deutsche Telekom wants to replace its 5G core from Huawei in the German 5G network with an Open-RAN core developed jointly with Mavenir.

Open-RAN à la 1&1

Even though the proponents of Open RAN want to make themselves independent of the major suppliers in principle, important network components are to be supplied by Nokia. For antenna technology, general contractor Rakuten Symphony relies on NEC, servers come from Dell and other Open RAN-capable network technology from QCT.

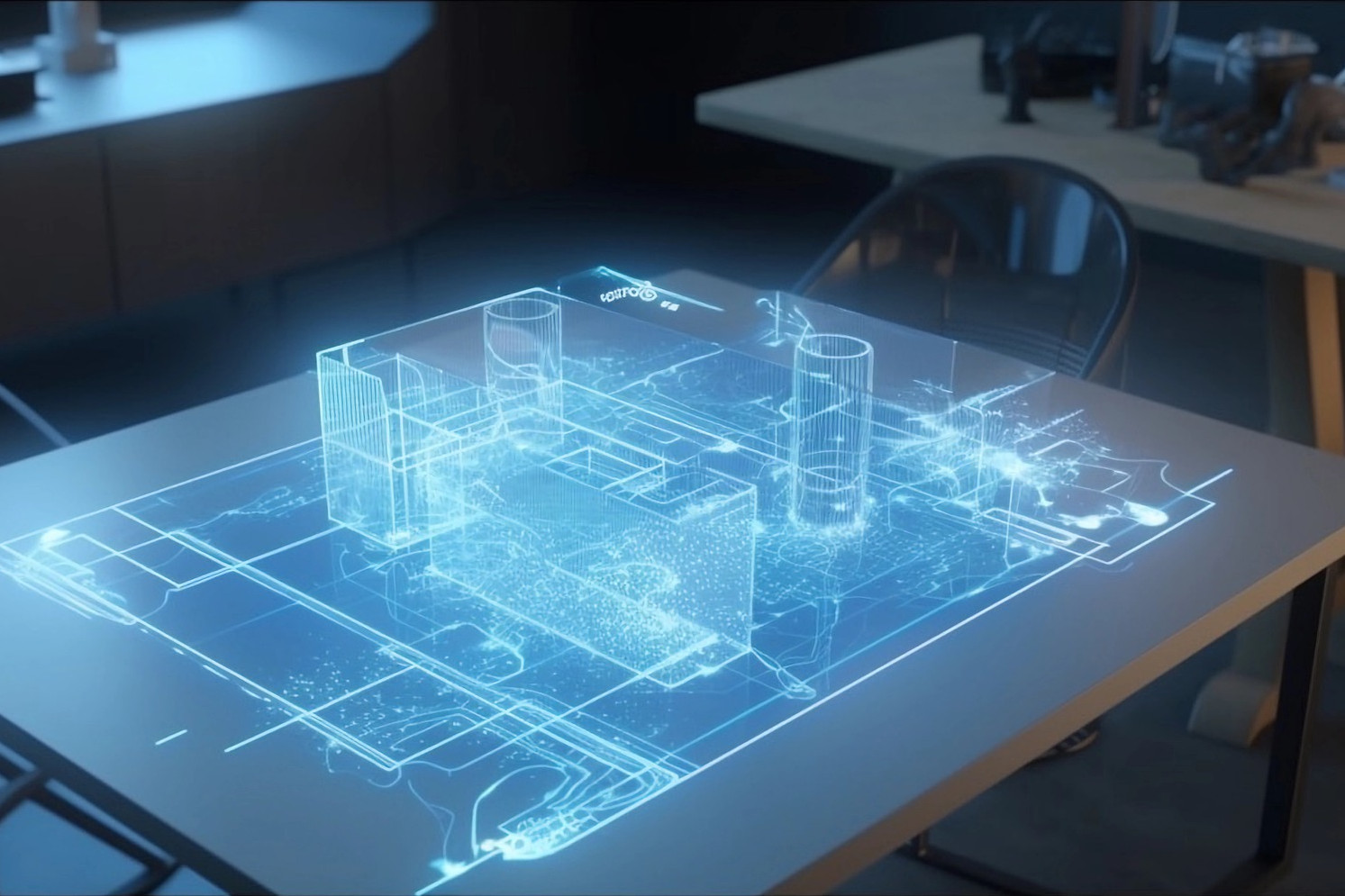

In 1&1’s Open RAN network, elementary functions run on edge servers in the data center. (Source: 1&1)

Around 500 Far-Edge servers are to ensure that the signal runtimes remain short and the data lines are relieved. They will be connected mainly via the 1&1 subsidiary Versatel, which has its own fiber optic network of more than 50,000 km as well as the required data centers. Around 20 to 30 edge data centers are to be connected to the far-edge servers. As part of the Open RAN approach, numerous network services will be mapped in private clouds as virtualized fronthaul, midhaul and backhaul functions.

1&1 is relying on Gesellschaft für Telekommunikation Deutschland (GfTD) as the general contractor for at least 500 new sites, according to an April announcement. The company had taken over parts of Nokia Siemens Networks-Services (NSN-S), which was wound up at the time, in 2013 and parts of the services division of Huawei Technologies Deutschland in 2015. As part of the “white spots” program, GfTD was already creating several hundred antenna sites for 1&1 from the beginning of 2020. Although the provider does not want to name the partner responsible for the delay in the network rollout. However, due to the size of the order, it seems likely that it is GfTD.

Other cooperation partners include the German subsidiary of American Tower Corporation (ATC), which assists in the search for co-location sites and leases antenna masts to 1&1. ATC Germany Holdings operates 15,000 radio masts throughout Germany. The mobile communications provider has leased additional masts from Vantage Towers. 3,800 of the latter’s rooftop and mast sites are to be equipped with 5G systems from 1&1 by the end of 2025; the number can optionally be expanded to 5,000.

Also involved is Media Broadcast, a subsidiary of freenet, which is to guarantee round-the-clock maintenance of the high-performance antennas at several thousand sites and maintenance as well as rapid fault clearance in the event of problems at the data centers.

Mobile communications initially without mobility

The previous plan called for the 1,000 antenna sites to be operational by the end of 2022, but not the planned mobile communications network. Instead, the sites were initially to be used exclusively for FWA (fixed wireless access) services, i.e., as an alternative to wired fixed-network connections.

The 5G mobile network is scheduled to launch in mid-2023. This is also related to the delays in concluding a national roaming agreement. Only after the courts, the Federal Network Agency (BNetzA) and even the European Commission became involved were Telefónica / 02 and 1&1 able to settle the dispute over the level of appropriate roaming charges and agree on an agreement. This will come into force on July 1, 2023 and is initially limited to two years.

1&1 can extend the term unilaterally until June 30, 2029. In addition, an extension for a further five years until mid-2034 is possible at 1&1’s request if both sides can agree. According to the two cooperation partners, extensive preparations are required in the Telefónica network for national roaming, making an earlier start impossible. The same applies to roaming abroad. So if the commissioning of the first 1,000 masts succeeds by summer 2023 and roaming is also set up in time, the mobile network could start without delay.

Roaming without 5G

The national roaming agreement stipulates that customers of 1&1’s new mobile network will automatically be supplied via the Telefónica network in all areas of Germany that do not have their own network access. However, they will not have access to 5G there, only 2G and 4G. In areas that 1&1 supplies itself, roaming is prevented.

1&1 mobile products sold to date are based on the Telefónica mobile network. This affects around 11 million customers. They will be migrated gradually over a two-year transition period starting in fall 2023 and will continue to have 2G, 4G and 5G access on the Telefónica mobile network until then. This could still cause trouble if the customer wants to use 5G: After the migration, the faster mobile standard will only be available in 1&1’s – limited – expansion area. Conversely, older cell phones and smartphones might not be able to cope with the 1&1 network, because it offers neither 2G (GSM) nor 3G (UMTS/HSDPA), which has since been discontinued by all German providers.

Faster expansion announced

The motivation to improve coverage quickly is correspondingly high. However, the currently available frequency equipment stands in the way of this. As a result of the auction, 1&1 can only access frequencies in the 3.6 GHz spectrum. Due to their physical properties, these are only suitable for use in conurbations, as they have a limited range. In addition, there are Telefónica frequencies at 2.6 GHz, which are available to 1&1 until the end of 2025 due to EU requirements. They enable somewhat larger radio cells. The other frequencies purchased at auction in the 2 GHz spectrum will not become available until 2026.

On Dec. 31, 2025, the license period for 800 MHz frequencies suitable for large-area coverage will also end, similar to frequency ranges at 700 and 900 MHz that will become free later. 1&1 CEO Ralph Dommermuth wants to ensure that these frequencies are not simply extended or awarded again in a costly bidding battle. He pleads for a fair distribution in order to be able to build his network competitively throughout the country. The BNetzA is currently examining various procedures and options. A decision would have to be made by the end of 2023 at the latest in order to enable timely award.

Until then, 1&1 must first concentrate on conurbations. The scharte at the first expansion target is to be made up for quickly. With the currently available frequencies, the expansion target for 2025 is to be achieved on time, and the telecommunications company wants to achieve coverage of 50 percent of the population even before the set deadline of 2030.

Leave A Comment